ETH Price Prediction: Breaking Through $4,200 as Institutional Demand Meets Technical Strength

#ETH

- Technical Breakout Potential: ETH trading above key moving average with Bollinger Bands suggesting upward momentum

- Institutional Confidence: Major players accumulating $220M+ during market dips indicating strong belief in future appreciation

- Ecosystem Growth: Foundation-led security initiatives and increasing stablecoin volume demonstrating real-world utility and adoption

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

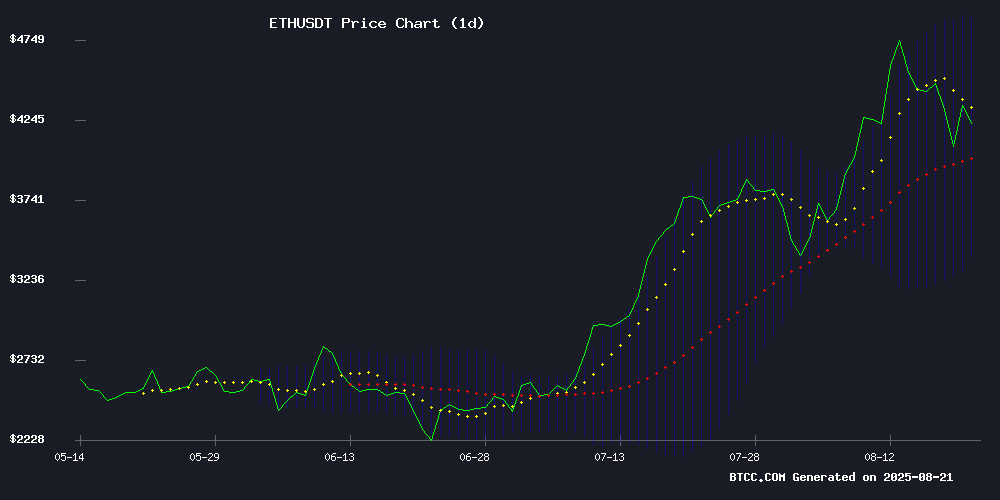

ETH is currently trading at $4,326.86, firmly above its 20-day moving average of $4,141.66, indicating underlying strength. The MACD reading of -402.34 remains in negative territory but shows improving momentum with the histogram at -60.69. Bollinger Bands position the price NEAR the upper band at $4,898.44, suggesting potential resistance ahead while the middle band at $4,141.66 provides solid support.

According to BTCC financial analyst Mia, 'ETH's position above the 20-day MA combined with tightening Bollinger Bands suggests consolidation before a potential breakout. The MACD, while negative, shows diminishing bearish momentum which often precedes trend reversals.'

Market Sentiment: Institutional Accumulation and Innovation Drive ETH Optimism

Recent developments paint a robust picture for Ethereum's ecosystem. BitMine's aggressive $220 million accumulation during market dips demonstrates strong institutional confidence, while the ethereum Foundation's trillion-dollar security initiative addresses critical UX concerns. The $521,000 monthly stablecoin transfer volume per user highlights unprecedented network utility.

BTCC financial analyst Mia notes, 'The combination of institutional accumulation, security enhancements, and real-world utility metrics creates a fundamentally strong backdrop. The market is clearly anticipating a key breakout above the $4,200 level despite recent volatility.'

Factors Influencing ETH's Price

Shineco Stock Surges 45% on Ethereum-Based Cellular Blockchain Venture

Shineco's Nasdaq-listed shares (SISI) skyrocketed 45% in premarket trading following a blockchain partnership announcement. The Chinese agribusiness firm unveiled a cellular asset tokenization agreement with Plus Me Limited, targeting stem cell management on Ethereum's network.

The collaboration will develop a digital custody system for mesenchymal stem cells, incorporating smart contracts for ownership verification and NFT-based identifiers. Shineco secured majority control of cryogenic storage specialist Xi'an Dong'ao Health Management to provide physical asset backing for the tokenized cells.

Despite the rally, SISI remains down 98% year-to-date amid heavy trading volume exceeding 13 million shares. The move represents a strategic pivot toward blockchain-powered biotech solutions, leveraging Ethereum's infrastructure for asset digitization in the healthcare sector.

Ethereum Foundation Launches UX-Focused Trillion Dollar Security Push

The Ethereum Foundation has unveiled the first phase of its Trillion Dollar Security initiative, targeting wallet usability and transaction safety as critical priorities. This strategic move follows an extensive ecosystem survey to identify high-impact vulnerabilities across Ethereum's infrastructure. The foundation aims to establish security benchmarks capable of supporting billions of users and trillions in on-chain value.

Wallet security emerges as the initiative's primary focus, with the introduction of minimum safety standards for Ethereum wallets. These evolving guidelines will help users navigate toward more secure options while adapting to emerging threats. Walletbeat, a security auditing project receiving foundation grants, will play a key role in defining and enforcing these standards through transparent ratings—a model reminiscent of L2BEAT's successful implementation.

The initiative specifically addresses blind signing risks by enhancing transaction clarity. New developer tools and smart contract alerts aim to mitigate risks at their source. This comprehensive approach reflects Ethereum's commitment to becoming the secure foundation for decentralized finance's next growth phase.

Cold Wallet’s $6.3M Presale Gains Momentum as Ethereum Hits $566B Market Cap

Cold Wallet’s presale has surged to $6.3 million, capturing attention as Ethereum’s market capitalization reaches $566 billion and Arbitrum strengthens its position with MEV staking rewards. Unlike transactional platforms, Cold Wallet embeds user progress into a narrative-driven experience, transforming ranks like 'Cold Start' and 'North Star' into markers of identity and commitment.

The platform’s layered journey—from unlocking the 'Icebreaker' title to carving influence at 'Glacier'—resonates with users seeking meaning beyond mere functionality. In a market often dominated by data, Cold Wallet stands out by turning growth into a personal saga, positioning itself as a contender for the best crypto investment of 2025.

Best Crypto Presale to Buy Now: Why Pepeto Tops BlockDAG and Maxi Doge

The presale market is heating up as investors seek the next high-potential crypto projects. BlockDAG, Pepeto, and Maxi Doge are drawing attention, each with distinct value propositions and risks.

BlockDAG has raised $363 million at $0.0276 per token, leveraging its proprietary blockchain and mobile mining features. A partnership with Inter Milan and new app releases have fueled momentum. Yet questions linger about whether marketing can sustain long-term value without deeper utility.

Maxi Doge rides meme culture, amassing $150,000 in 24 hours during its presale. Its community-driven approach echoes Dogecoin's early days, but longevity hinges on delivering tangible utility beyond viral hype.

Pepeto, built on Ethereum, stands out for its working product foundation—a critical differentiator in a market where execution often lags behind promises. Its emphasis on functional use cases positions it for sustainable growth as the presale frenzy evolves.

Ethereum Commands $521K Monthly Stablecoin Transfer Volume Per User

Ethereum continues to dominate the stablecoin market with an average monthly transfer volume of $521,000 per holder, according to data from Our Network. The blockchain hosts 51% of the total stablecoin market cap, valued at $142.6 billion, underscoring its pivotal role in institutional crypto settlements.

Stablecoin activity on Ethereum reflects growing institutional adoption, with fiat-pegged tokens increasingly used for large-scale transactions. The broader stablecoin market has expanded to $275.5 billion, adding $9.06 billion in liquidity as demand surges.

Ethereum-Based Meme Coin Pepescapes Raises $1.2M in Presale, Garnering Crypto Community Support

Pepescapes, an Ethereum-based meme coin, has surpassed a significant presale milestone by raising $1.2 million and distributing millions of tokens to early investors. The project's rapid traction positions it as one of 2025's most anticipated meme coins, with each presale phase attracting escalating demand.

Unlike typical meme-driven projects, Pepescapes merges viral appeal with tangible utility, targeting both retail enthusiasts and institutional crypto participants. Its community-centric approach fuels growth through organic social media engagement, including memes, fan art, and analytical discussions. Regular AMAs and transparent developer updates cultivate grassroots advocacy.

The project underscores credibility through partnerships with security auditor Coinsult and exchange platform Gigacex. A proprietary trading platform is under development to ensure end-to-end control over security protocols and user experience—a strategic move distinguishing Pepescapes from competitors reliant on third-party infrastructure.

BitMine Aggressively Accumulates $220M in ETH During Market Dip

Tom Lee's BitMine has seized the Ethereum downturn as a strategic buying opportunity, acquiring 52,475 ETH worth $220 million. The firm's treasury now holds 1.57 million ETH valued at $6.6 billion, cementing its position as the second-largest crypto treasury company after surpassing MARA Holdings.

Lookonchain data reveals the latest purchase originated from BitGo's hot wallet, executed as ETH tested the $4,200 support level. BitMine's accumulation strategy has accelerated during the dip, with $1.7 billion in ETH added last week alone. The company aims to control 5% of Ethereum's total supply, positioning itself as a market maker in the asset's long-term trajectory.

Separately, Shaplink Gaming demonstrated similar conviction, purchasing 143,593 ETH between August 10-17 at an average price of $4,648. The gaming firm now holds 740,760 ETH and has earned 1,388 ETH in staking rewards since June—a testament to the growing institutional embrace of crypto-native yield strategies.

Hacker Turns $53M Radiant Capital Theft Into $94M via Ethereum Trading

A cybercriminal who stole $53 million from DeFi protocol Radiant Capital in October 2024 has nearly doubled their haul through strategic Ethereum trades. The attacker converted the initial loot into 21,957 ETH when the cryptocurrency traded near $2,500, then rode the market's upward trajectory.

Blockchain analysts trace the attack to North Korea's AppleJeus hacking collective. The stolen funds continue circulating through Ethereum-based transactions, with recovery efforts proving ineffective. Security experts note the hacker's patience in holding ETH positions demonstrates sophisticated market timing uncommon in typical crypto heists.

The case highlights both the vulnerabilities in DeFi protocols and the profit potential of well-timed cryptocurrency plays—even with illicit funds. Ethereum's price appreciation provided an unexpected windfall, transforming a major theft into a nine-figure crypto fortune.

Anonymous Trader Loses Fortune after Ethereum Rocket Ride

An anonymous cryptocurrency trader saw staggering gains turn to dust in a volatile Ethereum trade. Starting with a $125,000 long position, the trader's portfolio ballooned to $43 million at its peak—only to collapse back to $771,000 after market turbulence.

The trader initially locked in $6.9 million in profits on August 18, a 55x return on investment. But subsequent attempts to ride Ethereum's volatility erased most gains, demonstrating the double-edged nature of leveraged crypto trading.

At the trade's zenith, the position size reached $303 million—a testament to both Ethereum's liquidity and the risks of compounding leveraged positions. The episode underscores how quickly fortunes can reverse in crypto markets, even for seemingly successful strategies.

Sports Betting Giant SharpLink Expands Ethereum Holdings Amid Market Volatility

SharpLink Gaming has aggressively increased its Ethereum exposure with a $667 million purchase, acquiring 143,593 ETH at an average price of $4,648. The sports betting platform now holds 740,760 ETH worth $3.2 billion, making it one of the largest corporate holders of the cryptocurrency.

The company is actively participating in Ethereum's proof-of-stake network, generating 1,388 ETH in staking rewards since June. This strategic move comes despite reporting a $103 million Q2 net loss, primarily attributed to accounting treatments of liquid staked Ether positions.

Market reaction was mixed following simultaneous disclosures of director stock sales totaling $1 million and a 12% single-day share price drop. The Ether acquisition positions SharpLink as a bellwether for institutional crypto adoption, though questions remain about its hedging strategies during ETH's price volatility near all-time highs.

Ethereum Holds Strong at $4,200 as Traders Anticipate Key Breakout

Ethereum's price stability near the $4,200 level has reignited trader speculation about its next major move. Veteran trader Matthew Dixon emphasizes the critical nature of the $4,150–$4,200 support zone, suggesting a hold above this range could propel ETH toward $4,580 and potentially $4,950, continuing the uptrend that began at $3,000 earlier this year.

Market participants are weighing two primary scenarios: a bullish continuation if support holds, or a consolidation phase if immediate upward momentum falters. Dixon's analysis, grounded in technical rather than hype-driven factors, carries particular weight given his extensive trading background.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH presents a compelling investment opportunity. The price holding above $4,200 with institutional players like BitMine accumulating $220 million worth during dips signals strong confidence. The technical setup shows ETH trading above its 20-day moving average with Bollinger Bands suggesting potential upward movement.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $4,326.86 | Bullish (Above MA) |

| 20-Day MA | $4,141.66 | Support Level |

| Bollinger Upper | $4,898.44 | Resistance Target |

| MACD Trend | Improving | Momentum Building |

| Institutional Flow | $220M+ | Strong Accumulation |

The combination of technical strength, institutional demand, and ecosystem growth through initiatives like the Ethereum Foundation's security push creates a favorable risk-reward profile for medium to long-term investors.